An Enlarging Data-driven ICT Market in China--Analysis on Optical Module, Device and Chip Industry

- 2023-03-21 15:34:56

- Source:CIOE

- News label:ICT, optical module, optical device, optical chip, datacom, optical communication, telecom,

Optical Module Industry

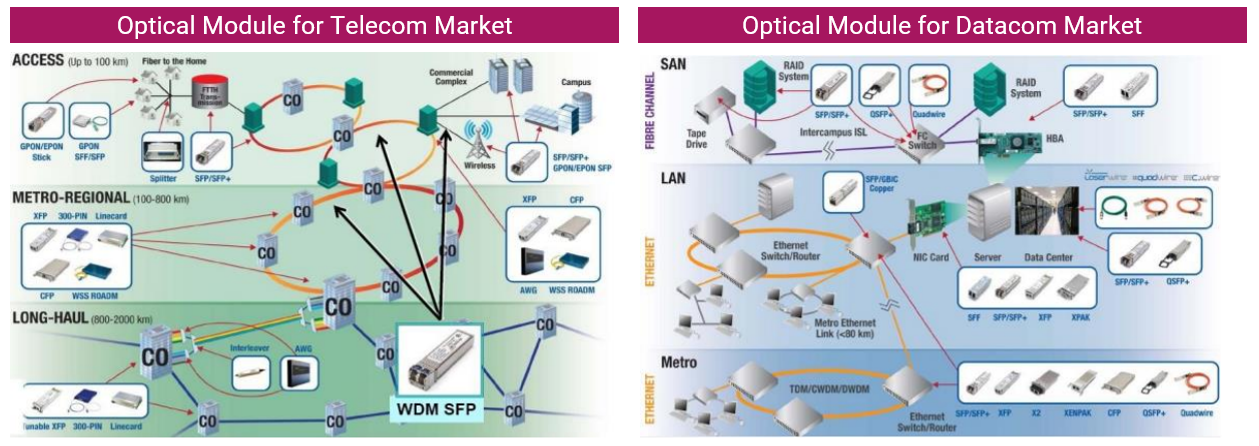

Optical communication application areas are mainly divided into telecom market, datacom market, and emerging market. The telecom market is the first market for optical communication, mainly including 5G communication, optical access, etc. The construction of communication network drives the market demand for optical communication. The datacom market is the fastest growing market for optical communication, mainly including cloud computing, big data, etc. The growth of data traffic and data interchange volume drives the market demand. Emerging markets include consumer electronics, autonomous driving, industrial automation, and more, which are the markets with the greatest potential for future development.

Optical communication device and module industry is mainly optical signal transmission and photoelectric conversion, involving photoelectric chips, optical components, optical devices, optical modules, optical communication equipment and telecom operators and cloud manufacturers. The optical communication industry can be divided into telecom and datacom. The technology of optical module industry is similar to that of LiDAR, consumer electronics, medical testing equipment and other fields.

◆ Telecom market - mainly used in base stations/PON/WDM/OTN/switches/routers and other equipment. According to Yole, the CAGR from 2020 to 2025 is about 5.3%.

◆ Data Center Market (Datacom Market) – the main applications are servers/top-of-rack switches/core switches and other equipment. According to Yole, the CAGR will exceed 25% from 2020 to 2025.

Source: ifiber

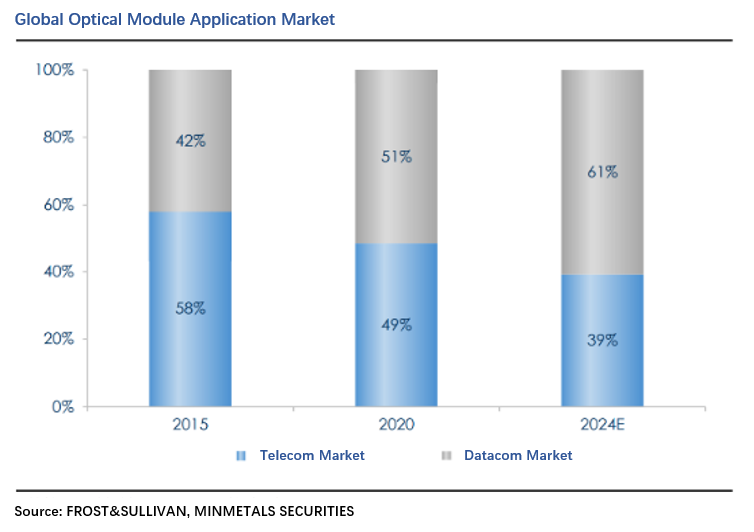

According to FROST & SULLIVAN, the global optical module market size grew from $7.51 billion in 2015 to $10.54 billion in 2020, at a CAGR of about 7.0%, and is expected to reach $13.82 billion by 2024. The growth rate of the datacom market is higher than that of the telecom market, with the market size of optical modules in the datacom market growing from $3.15 billion in 2015 to $5.42 billion in 2020, at a CAGR of 14.5%, and increasing the proportion of the market from 41.9% in 2015 to 51.4% in 2020. As the downstream demand for 5G network and data center construction will continue to increase, optical modules for the telecom and the datacom market will continue to grow. The datacom market benefits from data center construction and grows at a faster rate, and the telecom market is subject to the development strategies of telecom operators themselves, and the demand for optical modules is relatively stable. It is expected that by 2024, the proportion of global optical module applications in the datacom and telecom market will be 61% and 39%, respectively.

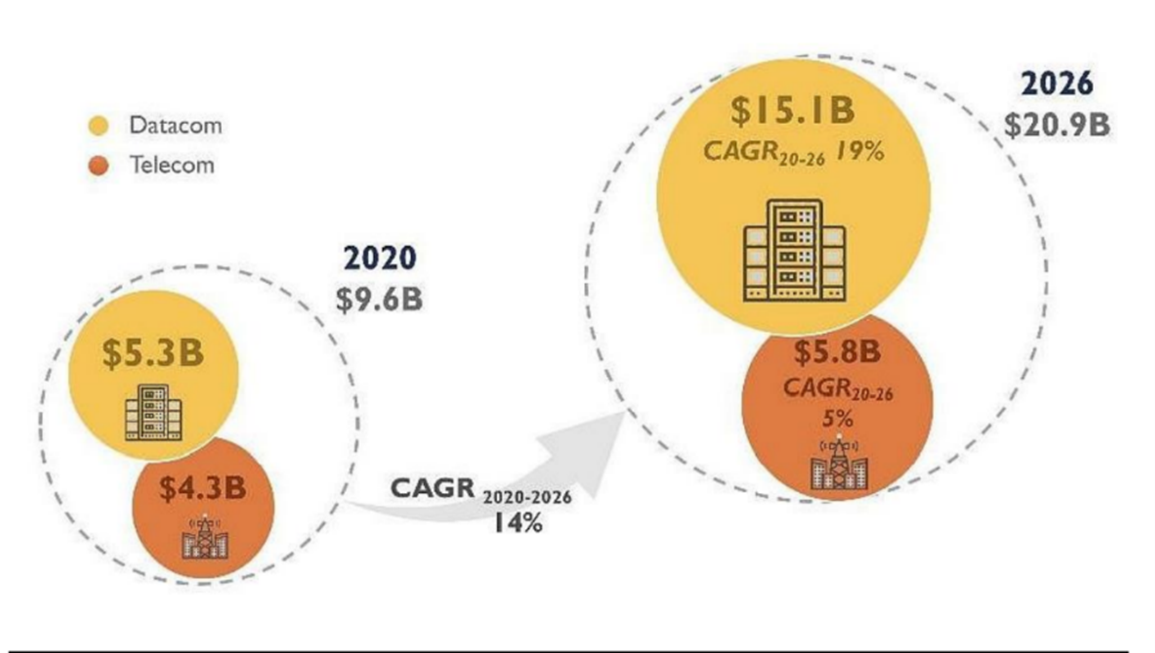

The global optical module market is expected to reach $20.9 billion by 2026. According to Yole, the global optical module market will reach $9.6 billion in 2020, with the telecom market accounting for $4.3 billion, or 45%, and the datacom market accounting for $5.3 billion, or 55%. With the advent of 5G commercial era, the optical module market will enter a new growth cycle driven by high data rate module applications, large cloud services and national telecom operators. According to Yole, the optical module market revenue is expected to reach $20.9 billion in 2026, growing at an estimated CAGR of 14% from 2020 to 2026, including $5.8 billion in the telecom market, growing at a CAGR of 5%, and $15.1 billion in the datacom market, growing at a CAGR of 19%.

Optical Device: An Important Part of Optical Module

Optical devices are an important part of optical modules, accounting for 37% of the cost, mainly including TOSA, ROSA and components that make up TOSA and ROSA, such as TO, WDM, TO tube, TO cap, isolator, lens, filter, and other supporting parts.

Optical devices can be divided into active optical devices and passive optical devices. According to Ovum, in the optical communication devices market, active optical devices occupy the majority of the market share, accounting for about 83%, and the market share of passive optical devices is about 17%.

In terms of products, China's passive optical device products have relatively strong competitiveness, and active optical device products need to be further enhanced. China's optical device market sales growth rate is slightly higher than the global market and is expected to reach 29.8 billion yuan by 2023. Benefiting from the rising capital expenditure of global cloud vendors and the steady advancement of China's 5G network construction, China's optical device market has entered a new round of growth. According to the LeadLeo, the sales scale of China's optical device market will reach 29.8 billion yuan by 2023, with a CAGR of 12.1% from 2018 to 2023.

Development Trends

1. Break through the high-end core technology and improve the localization rate of core products. Chinese optical device manufacturers, while playing the advantage of low cost, gradually increase the investment in the research and development of high-end devices to improve the localization rate of core products. At the same time, they rely on capacity breakthroughs and began to lay out vertically integrated production lines, which are expected to further replace production capacity at all levels of the global optical device industry chain, driving Chinese manufacturers to expand their market share and enhance their bargaining power globally.

2. One-stop solution to create cost advantage. For downstream customers, a one-stop solution for procurement can improve their own procurement efficiency and meet customized needs comprehensively as well. One-stop solution is suitable for small batch sporadic procurement, which helps improve the production efficiency of downstream manufacturers.

3. Optical communication manufacturers have long-term accumulation in the optics field, technology and production lines have certain reusability, such as LiDAR, third-party medical inspection, AR glasses and other markets. At present, many manufacturers have entered the field of LiDAR, and the blessing of communication technology has opened a new dimension of competition. It is expected that by 2025, the global LiDAR market sales in the unmanned driving will reach $4.66 billion. In addition, the principle of optical modules in high-end laser inspection equipment is similar to that of optical device products. For optical communication manufacturers, the technology and manufacturing platform with a certain degree of reusability. With the development of China's medical testing market, it is expected to open up new growth space.

Optical Chip: The Core Component of Optical Module

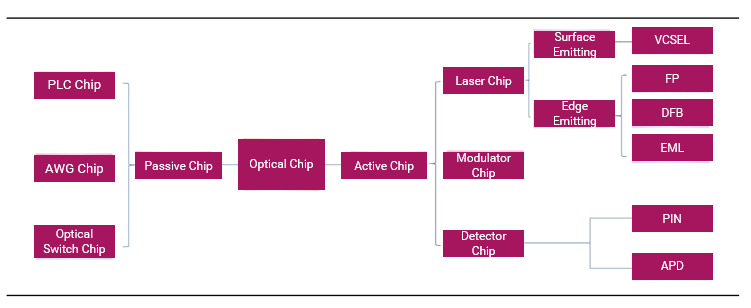

The optical chip is the core device of the optical module, and the cost ratio rises with the increase of the optical module speed. The performance and transmission rate of the optical chip directly determine the transmission efficiency of the optical communication system, and it is the core device of the optical module. Optical chips can be divided into laser chips and detector chips according to their functions. Among them, the laser chip is mainly used to transmit signals and convert electrical signals into optical signals, and the detector chip is mainly used to receive signals and convert optical signals into electrical signals.

Picture 4: The classification of optical chips

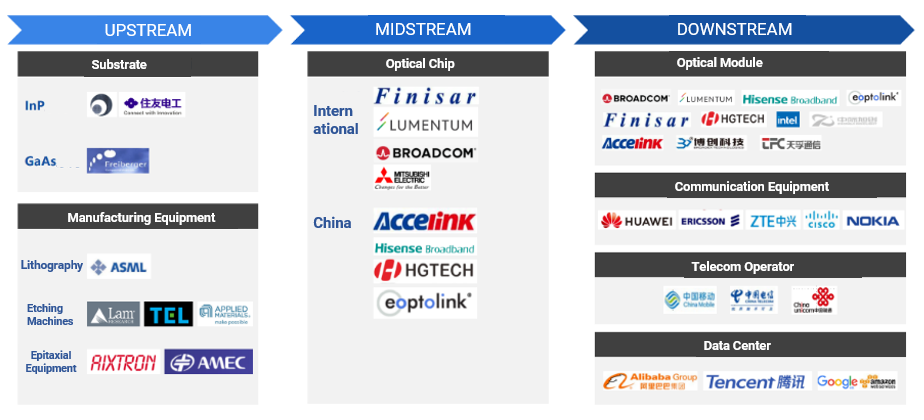

The upstream of the optical chip industry is mainly raw materials and production equipment suppliers. Optical chips generally use Ⅲ-V element compound semiconductors as substrates, and production equipment generally includes lithography machines, etching machines, external research equipment, etc. The midstream of the optical chip industry mainly provides active optical chips (mainly including laser chips and detector chips) and passive optical chips (mainly including PLC and AWG chips) for downstream optical module manufacturers. Downstream optical module manufacturers embed optical chips into optical devices and then package them with other structural components to make optical modules. Optical modules will be further applied in the communication equipment market, telecom operation market and data center market.

Picture 5: Industry Chain Map

Upstream: substrate market and lithography machine market are basically dominated by international giants, and Chinese enterprises in etching machine and epitaxial equipment are gradually catching up. At present, optical chip enterprises mainly use InP compounds and GaAs compound semiconductors with outstanding high frequency performance as the substrate of optical chips. The lithography machine market is completely monopolized by international giants, and the etching machine market and epitaxial equipment market are also dominated by international giants, but Chinese companies have broken the monopoly in some technology and application fields.

Midstream: optical chip-related companies generally adopt three types of models: Fabless, Foundry and IDM. Different models have their own advantages and disadvantages, and the IDM model has more advantages under the influence of intensified competition and external environment. Middle- and low-end optical active optical chips have mass production capacity, but the gap between high-end is obvious. Chinese companies have relatively obvious localization and import substitution capabilities in passive optical chips, some domestic companies have a relatively prominent share of the global market share. In the future, they will mainly promote the research and development of AWG and the expansion of overseas markets.

Downstream: optical module is an important carrier of the optical chip, and the optical chip is the largest part of the cost of the optical module. The optical module industry is in the stage of accelerated development and will achieve common development with the optical chip industry. The application of optical modules and supporting optical chips in the telecom market and data center market will continue to grow. The upgrade of fixed-line broadband and the expansion of coverage on this basis will support the optical chip industry. The deployment of 5G base stations will boost the growth of optical chip demand in the long term. The expansion of data center market scale lays the foundation for the enhancement and upgrade of the data center, which will strongly drive the demand growth of optical modules and optical chips. Silicon photonics technology will achieve a bottleneck breakthrough, and the subsequent growth of the silicon optical module market will effectively boost the demand for silicon photonics chips.

Outlook for the Communications Industry in 2023

The 5G network has entered the post-infrastructure era, and 5G coverage has shifted from breadth to depth. Driven by the background of the digital economy, the 5G industry from hardware to the software will realize space expansion and industrial upgrading under the accelerated promotion of domestic substitution and independent control.

On the supply side, high process chips and related equipment continue to be difficult to obtain due to the multi-pronged blockade by the United States. The 5G upstream semiconductor industry chain will usher in a large supply gap in high-end equipment, and independent control will accelerate.

China's 5G industry is in a booming time, with the world's leading infrastructure and the world's leading number of patents. The 5G industry will usher in better track layout opportunities from the hardware side such as semiconductors to the software side of the office software, databases, etc. At the same time, domestic products are making breakthroughs from the low-end to the high-end product, and the high-end product layout is expected to accelerate.

Media Contact:

Eileen

eileen.chen@cioe.cn