VCSEL market is expected to reach $3.9 billion by 2027, at a CAGR of 19.2%

- 2022-10-13 12:01:05

- Source:CIOE

- News label:VCSEL, Telecom, Consumer Electronics, Market Share

VCSEL (Vertical Cavity Surface Emitting Laser) is one of the core devices for optical communication, 3D sensing and other applications. VCSEL was firstly used in the optical communication industry. In the optical module, VCSEL ascts as the core of the emitting component, which accounts for nearly 40% of the cost of the optical module. With the promotion of technologies such as face recognition and 3D ToF in consumer electronics, making mobile and consumer products the largest market for VCSELs in 2018 with a size of $440 million.

However, a recent YOLE’s report shows that the VCSEL market has changed quite a bit in the last two years, from the supplier landscape to the growth rates of different markets.

Supplier structure: from an oligopoly to a duopoly

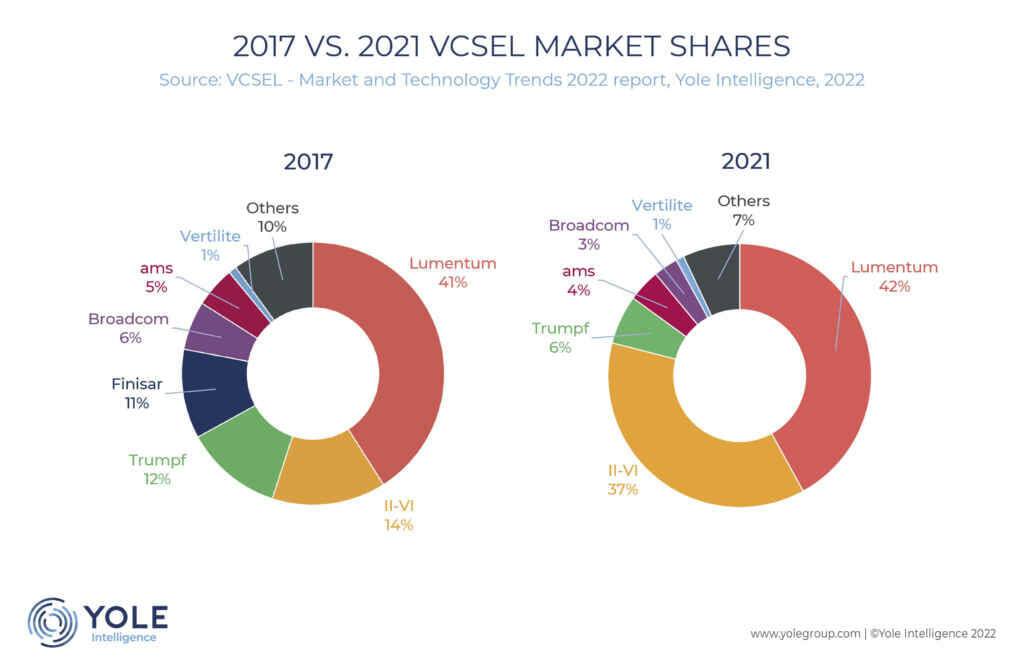

From the market data of the past few years, the market share of VCSEL vendors has changed dramatically since 2017. Prior to 2017, the VCSEL market was dominated by Lumentum, which accounted for 41% of the market share in 2017. The companies in the second tier of the market, including II-VI, Finisar, and Trumpf, all had a share of around 10% in that year.

Also, in 2017, Apple applied structured light face recognition on the iPhone for the first time. Lumentum was the only qualified VCSEL supplier for Apple that year, and other vendors including Finisar were still in the R&D stage and hope to get certified by Apple. Of course, VCSELs are not only used for structured light, but also in the proximity sensors (tws, cell phones), rear ToF, and LiDAR on the iPhone.

By 2021, Lumentum still had the highest VCSEL market share and its market share increased slightly to 42%. But the second-tier players were transformed by II-VI's acquisition of Finisar in 2019, with II-VI's market share reaching 37% by 2021, second to Lumentum, due to the merger with Finisar and the steady earnings as a supplier to Apple.

At this time, the combined market share of II-VI and Lumentum was close to 80%, while the second-tier players such as Trumpf, ams Osram, Broadcom, and Vertilite had their shares compressed to less than 5%.

For the second-tier players, there are not many market opportunities left for them, and the situation of duopoly will continue in the VCSEL market, with the head players continuing to consolidate their market position through mergers and acquisitions, and vertical integration becoming a major trend in the industry.

In 2018, Lumentum acquired laser company Oclaro for $1.8 billion. Oclaro has leading InP (Indium Phosphide) lasers and photonic integrated circuits and related components and modules capabilities, and focuses on telecom optical communications, enterprise networks, data centers and other markets, making up for Lumentum's lack of industry applications. After the acquisition of Oclaro, Lumentum's product line covers almost the entire industry of telecom, industrial and consumer electronics, and the improvement of product portfolio greatly improves the competitiveness of the company.

In 2019, II-VI completed the acquisition of Finisar, however, II-VI did not put down the pace of M&A integration. In July, II-VI announced the completion of the merger and integration of Coherent, a laser and laser systems company. After the merger, II-VI officially changed its name to Coherent, and the transition of the original name and brand identity to the new brand will be gradually completed in the coming months.

It is also worth mentioning that II-VI had a fierce competition with Lumentum for the acquisition of Coherent, and eventually succeeded with a higher offer.

Market segments: telecom is expected to surpass consumer electronics, automotive market growth is the fastest

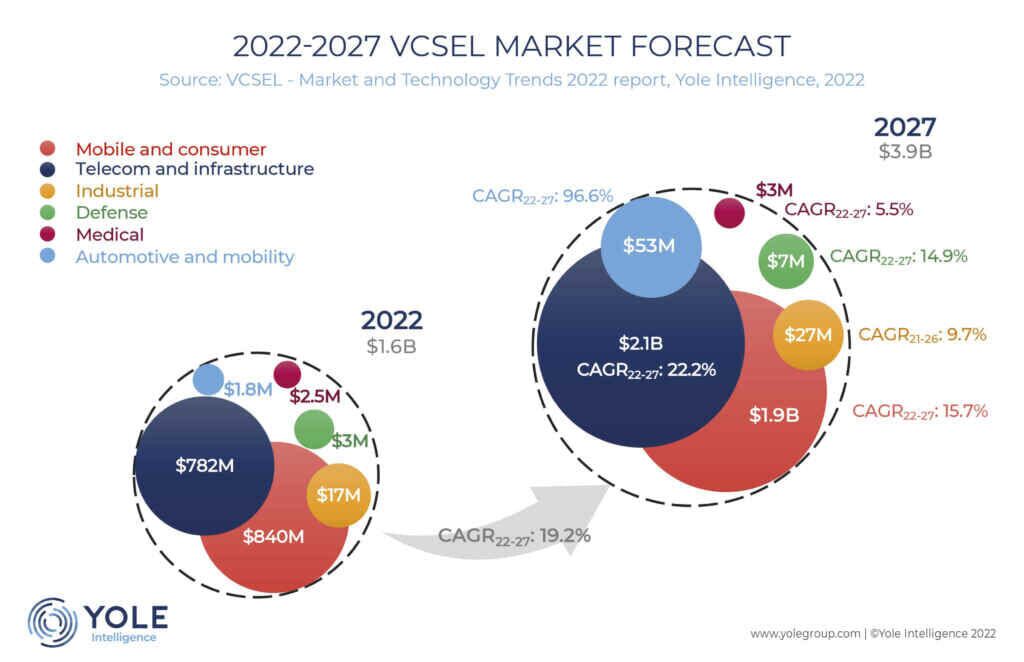

According to Yole's forecast, the overall VCSEL market size will reach $2.2 billion in 2022 and grow at a CAGR of 19.2% to reach $3.9 billion by 2027. One notable part is the market size of mobile and consumer electronics applications is higher than the telecom market, which is expected to be $840 million in 2022, while the market size of telecom applications in the same period is $782 million.

VCSELs for face recognition are currently used exclusively by Apple in smartphone applications, and Android manufacturers have now almost all opted for under-screen fingerprint recognition to replace structured light or ToF face recognition over the past few years. Meanwhile, the TWS market has slowed down its growth as demand for smartphones has slowed. As for VCSEL applications, the next growth in consumer electronics may lie in XR, but it is clearly difficult to replicate the previous demand growth on smartphones and TWS.

YOLE estimates that the market for VCSELs in mobile and consumer industry will grow at a CAGR of 15.7% between 2022 and 2027, while telecom will grow at a CAGR of 22.2%. The telecom industry benefits from markets such as data centers and 5G communications. The exponential growth of data volume in the future will contribute to the continued growth of demand for optical modules and others in the data industry.

Meanwhile, the growth of the automotive market is also noteworthy. As the LiDAR market is driven by automatic driving technology, the demand for VCSEL, one of the important lasers emitting components for LiDAR, cannot be ignored. Yole forecasts a CAGR of 96.6% for automotive industry from 2022-2027, with the segment market size growing from USD 18 million in 2022 to USD 530 million by 2027.

Summary

As the VCSEL industry trend moves toward vertical integration, there are few opportunities left for other VCSEL manufacturers. But for domestic manufacturers, there are still domestic alternative opportunities. In fact, the technical strength of leading VCSEL chip makers in China are already capable of approaching Lumentum and II-VI, such as Vertilite, which just received a new round of financing in August and currently accounts for about 1% of the global market share, and Everbright, which was listed on the Science and Technology Innovation Board in April this year.

Media Contact:

Cassie Wang

cassie.wang@cioe.cn